how to lower property taxes in nj

How to lower property tax User Name. I used to work with someone who lived in Tabernacle and managed to sell over 600 worth of hay each year to get a 90 subsidized agricultural exemption on his 8 acres.

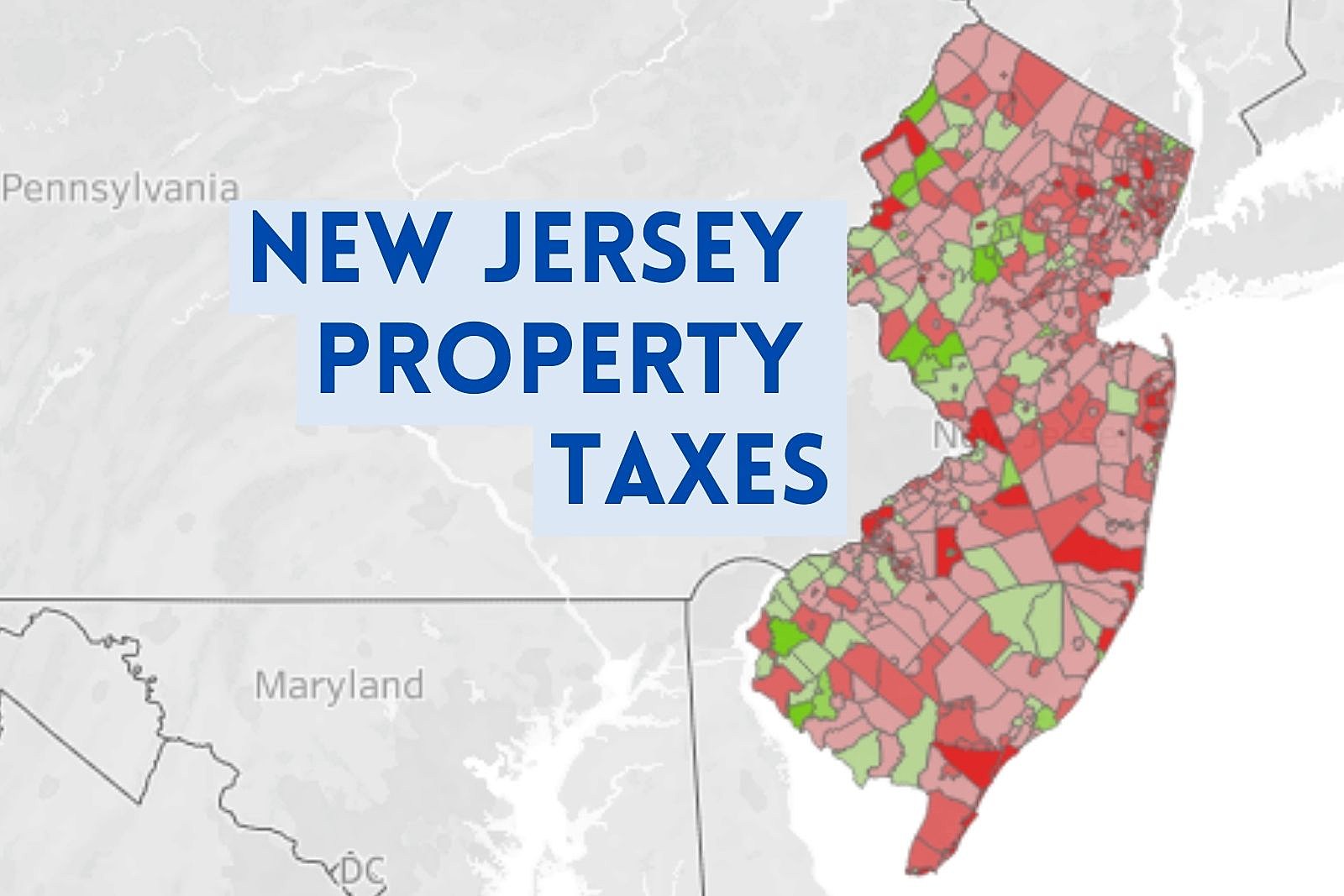

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

One reason property taxes are so high in New Jersey is simply because property values are high he explained.

. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Dont build or make changes to your curbside just before an assessment as these steps may increase your value. It allowed us to create a login.

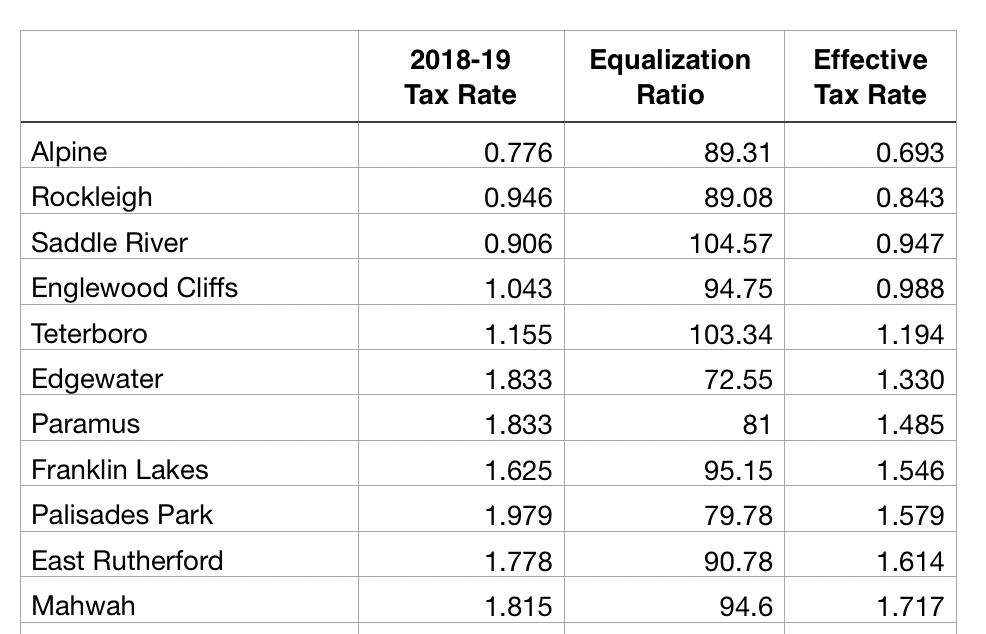

New Jerseys average property tax bill rose 172 over the same period last year and is among the highest in the country. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation. If these three ratios are not between 0 and 1 then divide them by 100.

The common property tax exemptions in New Jersey are. Click on your county. The easiest way of lowering your property taxes is by applying for exemptions.

Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law. 250 veteran property tax deduction. How much are property taxes going up in NJ.

The tax deduction for veterans in New Jersey is 250. Businesses do more. Find the three tax ratios for your city.

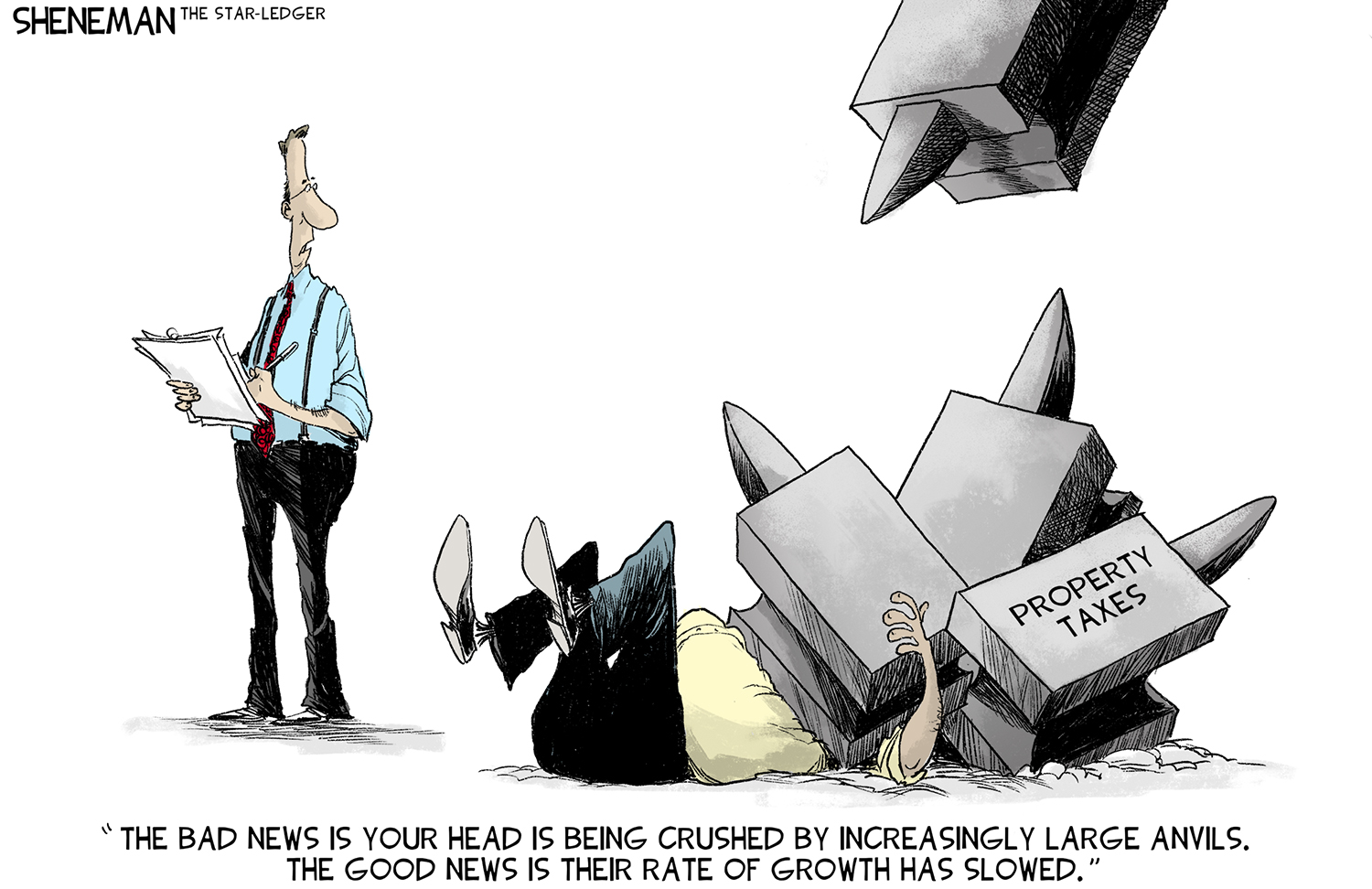

Municipalities across New Jersey have found a way to do the impossible. The standard measure of property value is true value or market value that is what a willing. How To Lower Property Taxes in NJ and Appeal Them With DoNotPay.

General Property Tax Information. If the current year is higher you get the difference as your reimbursement. Encourage residents to support local businesses while at.

Here are five interventions to cut spending and reduce property taxes. New Jerseys real property tax is an ad valorem tax or a tax according to value. Go to the New Jersey Division of Taxation website through the link in the References section.

The measure would change the deduction for rent payments considered as property taxes from 18 to 30. A lot of research is involved as well as form and document collection. A homestead exemption is one of the most common exemptions.

Why are NJ school taxes so high. Encourage residents to support local businesses while at the same time lowering their property taxes. Name Lower Township Tax Collector Address 2600 Bayshore Road Ste 5 Villas New Jersey 08251 Phone.

How Can I Lower Property Taxes in NJ. You will always compare your base year to your current year property tax amount. There has however been a notable increase in property taxes in the most affluent communities in the Garden State which can result in homeowners seeing an average hike of more than 700.

New Jersey has one of the highest average property tax rates. On average the states property taxes rose 1 percent from 8953 to 9112 between 2019 and 2020It was lower than the 2 percent cap former Gov. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help you win it.

Sold firewood cut from trees on her estate to get the tax break. Your county tax board can adjust this percentage figure which is also known as the assessment ratio. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Give power back to the people of New Jersey New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to. Dealing with exemptions and appeals by yourself can be too much to handle. The data released this month comes from the state Department of Community Affairs.

The exemption for disabled veterans is 100. Short of moving to a smaller home or another state appealing the assessment of a property is how homeowners can lower their tax bills said Anthony DellaPelle a partner at McKirdy Riskin Olson. Armed forces veterans will defer their property taxes.

Give the assessor a chance to walk through your homewith youduring your assessment. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. There are programs that might help you lower property taxes in New Jersey.

City-Data Forum US. The base year will not change unless your property tax amount is less than the base year. But the states steep education costs are another big factor.

Forums New Jersey. Chris Christie put into effect in 2011 according to the analysis. Mortgage Relief Program is Giving 3708 Back to Homeowners.

Find the three tax ratios for your city. You may also need to contact. Check Your Eligibility Today.

The cost to educate a pupil in New Jersey is one of the highest in the country Mr. For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364 Now they are between. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land.

Tax amount varies by county. 189 of home value.

Where Are The Lowest Property Taxes In Florida Mansion Global

The Ten Lowest Property Tax Towns In Nj

Nj Property Tax Relief Program Updates Access Wealth

The Ten Lowest Property Tax Towns In Nj

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

The Ten Lowest Property Tax Towns In Nj

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

The Ten Lowest Property Tax Towns In Nj

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News